Brief Overview

XNET is a carrier-grade DeWi network designed for native interoperability with incumbent network operators. By striving for native compatibility with the legacy telecom ecosystem from day one, we believe XNET is best positioned to achieve meaningful data transfer revenues from carrier offload as soon as 2023-2024.

XNET is co-founded by Richard Devaul, Tom Beirith, and Donal O’Brien. Rich is a former technology executive at Google X who led R&D for Project Loon, Google’s effort to provide internet coverage via a network of stratospheric balloons. Tom and Donal are long-time telco executives and entrepreneurs who most recently built Point Dume, a converged roaming business based in Hong Kong. Their insights and relationships from careers building, operating, and selling networks - combined with inspiration from the rapid growth of Helium’s LoRa network - led to the launch of the XNET project in early 2022.

XNETMNO, the first participant on the XNET network, will influence validation, rewards, governance, and economics during the bootstrapping phase of the network, until key functions can be decentralized while maintaining carrier-grade quality. Long-term, XNET’s vision is to become the first community-owned neutral host offload network.

What Makes XNET Special (and Different!)

1. Potent combination of killer engineering talent and domain expertise.

Rich started his career off as a PhD grad at MIT, started a fitness wearables company, joined Apple’s engineering team, and then joined Google X in 2011 (Director of Rapid Evaluation and Mad Science). Rich is cited as an inventor in over 70 patents from his time at Google and eventually became one of the leading technology execs at the company, reporting to Larry/Sergey and the board of directors, as well as co-founding and leading technical efforts for Project Loon - Google’s attempt to provide internet coverage via stratospheric balloons.

At Loon, Rich led teams of dozens of engineers and helped allocated hundreds of millions of dollars of cumulative funding over 5+ years, and built relationships across the global telecom industry. He is complemented by Tom and Donal’s experience and relationships in the telco industry, including with network operators, software vendors, and service providers. They are bringing on A+ talent across all disciplines - for example, with Alex Luebke leading hardware - and are actively hiring to help build the future of DeWi. (reach out to careers@xnet.company)

2. Technical architecture conducive to tier-1 offload partnerships.

Project Loon’s idea was sound from an engineering perspective: balloons, given their altitude, can provide coverage to an area 20-200x larger than a cell phone tower, and they pay zero rent. Loon’s network was data-only (lacked voice calling and SMS capabilities), but apps like Whatsapp/Facetime were quickly eliminating the need for legacy voice/SMS anyways. Structurally, Loon’s network could profitably provide coverage in areas where ground-based networks simply could not — it felt like a home run.

But after hundreds of millions of dollars invested over the better part of a decade, Google shut down the project in 2021, citing a failure to find a *[long-term, sustainable business [model].” The only successful deployments of Loon’s network was in Kenya (35K total users), in Peru after major flooding (160GB total data transfer), and in Puerto Rico after Hurricane Maria (100K total users). It turns out that, despite near-equivalence in users’ eyes, data-only networks are not a compelling value proposition for incumbent telcos. Technology execs at incumbent telcos are not incentivized to take risks on new technologies / integrations; they’re incentivized run reliable, efficient, stable networks.

These insights led the XNET team to make a few design choices that are unique vs Helium/Pollen. First, running a different (non-Magma) mobile core. Second, XNET will be more restrictive around location / backhaul / validation of nodes.

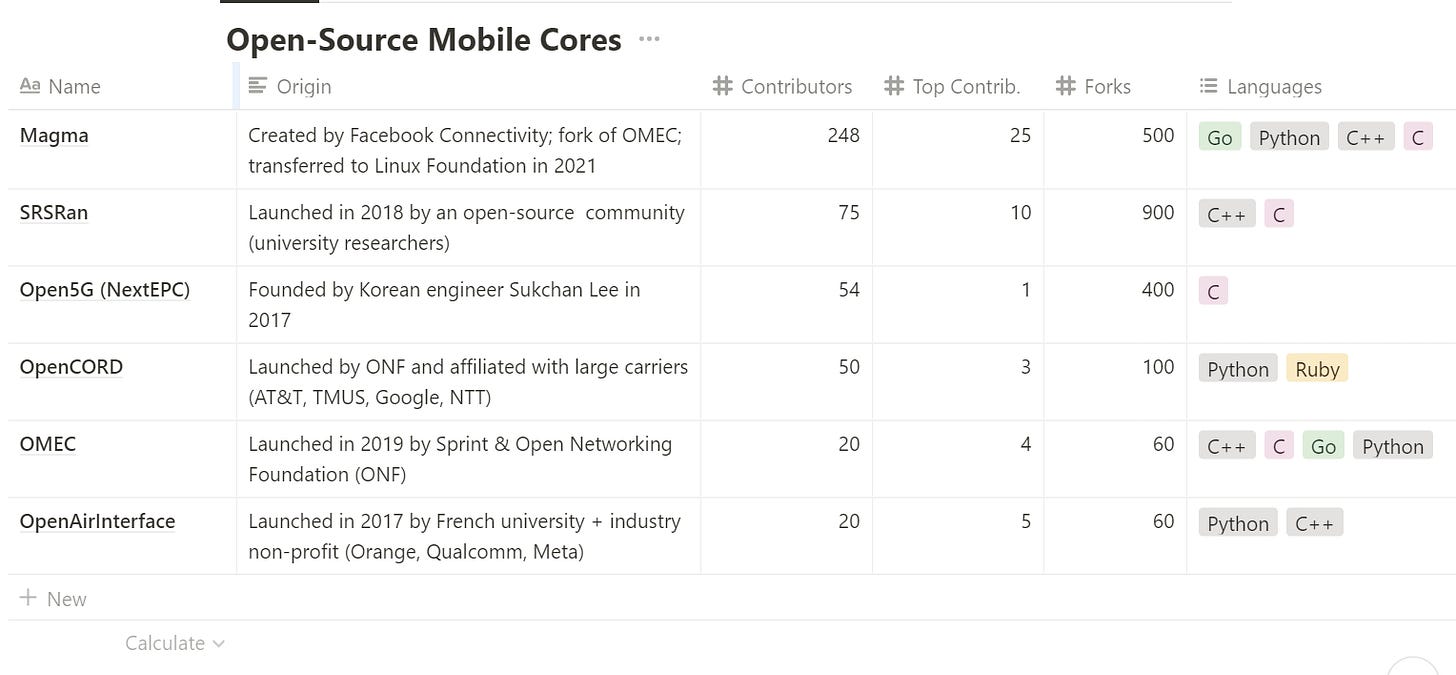

Mobile cores are complex software packages that standardize the interactions between networking equipment (radios/gateways) and end-user devices (mobile phones). Bringing a mobile core into production has historically been an engineering effort of $1B+ over 3-5 years, but nowadays there are at least a dozen mobile cores offered off-the-shelf from software companies (e.g., Azure, Oracle, Rakuten, Mavenir), equipment manufacturers (e.g., Nokia, Ericcson, Cisco), and even a number of open source projects (see below).

The most popular open-source core, Magma - which both Helium and Pollen are built on - was initially developed by Facebook Connectivity, later open-sourced (’19) and handed over to the Linux Foundation (’21). Magma was originally designed for providing fixed wireless via satellite; not for interoperability, or even compatibility, with the existing mobile/telco ecosystem.

We have independently verified this senior technology executives across the telco industry. One former CTO who had recently closely evaluated Magma told us that it needs to scale 100x+ before supporting a national offload partnership with a tier-1 carrier. Even executives with bullish perspectives on Magma were notably more reserved in their praise (e.g., saying “Magma could eventually become a carrier-grade core”). Across the board, technical execs were highly skeptical of Magma’s ability to support offload on a national scale in the next 1-2 years.

The DeWi mining community is already familiar with Magma’s scaling hurdles: spend some time in the Helium/Pollen discords and you’ll see issues related to FCC registration (a “good amount [of SAS registrations are BS]”), chip compatibility (”Magma on ARM is still in its infancy”), and mobile handoffs (”we see no automatic handoffs [on Magma]”). Handoffs are a particularly critical issue: since Magma was designed for providing fixed wireless to stationary buildings, all the runtime state associated with an end-device is stored on the local gateway. When a mobile phone disconnects from one gateway and connects to another gateway, the network treats it like a brand new connection, causing an annoying break in continuity-of-service for users.

Handoffs are a known problem in the Magma community, and developers - including those from Nova Labs and also Pollen Mobile LLC - are actively working to build workarounds to the core architecture. Given FreedomFi’s long history of contributions to the Magma codebase, Nova Labs’ ability to fund external development with the $200M it raised in ‘21, and the caliber of engineering talent across the FF/Nova/Pollen teams, we think it is possible that Magma is at par with carrier-grade mobile cores in ‘23. However, there are a number of credible reasons that suggest Magma will not reach parity with incumbent mobile cores until ‘24-’25. First, the number of Facebook engineers working full-time on Magma went from 35+ to ~zero (implies $10-15M per year of engineering spend, which for context is roughly equal to the total hardware sales for Pollen + Helium 5G miners to date). Second, Github commit activity for Magma has fallen by more than 50% since being transferred over to the Linux Foundation. Third, the companies involved have other major engineering priorities that compete with Magma (e.g., Helium’s L1 transition and MVNO). Even after Magma is ready from a technical standpoint, it could take years to convince incumbent telco executives to change their entrenched opinions about Magma’s capabilities.

The XNET network will leverage a mobile core that is natively compatible with incumbent telco networks from the start. While we can’t disclose information about XNET’s architecture (join the discord for updates), interested readers can find a wealth of information online about the leading open-source and closed-source mobile core packages. On the open-source side, Github commit activity shows Magma has a significant lead over other projects, although SRSran and Open5Gs also have long histories of development. On the closed-source side, the most innovative operator globally, Rakuten, deployed the first oRAN mobile core in Japan (their core, Rakuten Symphony, is now supporting Dish’s buildout in the US and 1&1’s in Germany). Independent performance tests suggest Symphony is an extremely capable core: at a scale of 5M+ mobile subscribers, the network ranks in the top decile of performance globally.

Beyond the choice of mobile core, XNET is deliberately taking a more iterative approach to network design, empowering XNETMNO to operate key functions of the network during the bootstrapping phase. First, in governance rights: XNETMNO will convert native tokens ($XNET) into data credits ($XNETD). Second, in economic rights: XNETMNO earns a fixed fee per epoch out of mining rewards in perpetuity (a different structure, albeit similar economic reality, to Helium’s HST). Third, in network operations: XNETMNO is setting the initial criteria, in terms of hardware / location / backhaul, for deployments to join the XNET network and earn rewards.

XNET’s philosophical approach is closer to Solana than Ethereum. By sacrificing on decentralization in the formative years of the network, XNET can iterate faster and manage MNO partner demands more nimbly than networks further along the path of decentralized governance. Any DeWi network with offload aspirations has to simultaneously build trust with three notoriously stubborn partners - the FCC, incumbent MNOs, and token-governed DAOs - and while XNET’s design choices may take time for DAO participants to digest, we believe they’re DeWi’s best shot at building networks that are undeniably useful and valuable.

3. Relentless focus on unit economics and long-term sustainability.

XNET’s incentive structure carefully balances the critical near-term and long-term objectives of its network (i.e., neutral host). Rewards must be sufficiently attractive to early miners, who incur significant actual costs (e.g., hardware, labor, insurance, backhaul, financing) as well as opportunity costs (e.g., mining other DeWi networks) to build out the network. Reward mechanisms must be clear enough to provide certainty to the mining community, while retaining flexibility to manage evolving technical, regulatory, and commercial issues without jeopardizing the core monetary policy of the ecosystem.

There are three ways DeWi miners evaluate deploying capital into new networks:

On a $ basis (spend $X to mine $Y). The method is simplest, and does not require miners to be opinionated towards the network. However, it lacks robustness, since market pricing is generally based on extremely thin liquidity. For example, PCN is currently “trading” at $0.06 but a $20K buy order would 3x the price.

On an ownership basis (spend $X to mine Y% of max supply). This method requires miners to have a point of view on the terminal value of the network, thereby eliminating the reliance on market data. However, this way of thinking structurally incentivizes miners towards networks with high early token issuance, where larger percentages of max supply are up for grabs, rather than networks that more thoughtfully balance token supply/demand over time.

On a token basis (i.e., spend $X to mine Y tokens, which I think will be worth $Z). This method is the most complex, because it requires miners to not only have a point of view of the terminal value of the network, but also on token supply/demand over time. While it requires the most assumptions, we believe it is the first-order correct method for making capital allocation decisions. The question for sophisticated miners becomes: 1) when do I want to sell my tokens? (and how flexible am I on this timing); 2) how much demand for the token will there be at that point in time? (and with what price sensitivity); and 3) how much liquid supply of the token will there be at that point in time? (and with what price sensitivity).

With respect to #1 (time horizon), XNET is best suited for miners with multi-year horizons who want to participate in building and owning a neutral-host mobile offload network; miners with time preferences measured in months should look elsewhere. On #2 (token demand), we’ve already discussed the potential to achieve meaningful mobile offload data transfer revenues in ‘23-’24. On #3 (token supply), the whitepaper details the following token allocations for a total of 24B tokens:

Operator Pool: 9.4B tokens issued to incentivize network buildout. This pool is set to be disbursed slowly to miners and validators over the next decades, with a line of sight to funding 5G and 6G buildouts. Once disbursed, these tokens have a 10-15 day lockup.

Foundation Pool: 4.3B tokens issued to support charitable works and incentivize coverage in underserved areas. This pool is set to be disbursed over a decade, with low issuance during the initial buildout phase.

Ecosystem Pool: 3.1B tokens issued to incentivize key strategic suppliers and partners. This pool is set to be disbursed over the next 2-4 years to support the initial buildout, followed by an 12-18 month lockup.

Investor & Insider Pool: 7.2B tokens, with a lockup of 36-48 months (through Q4’25). For context, these lockups are much longer than both Pollen (insiders unlock at 12/24/36 months) and Helium (insiders earned 35% of HNT rewards with no lockup via HST).

Beyond the supply/demand fundamentals and path towards on-chain data transfer, there are a number of reasons we’re excited about XNET’s protocol design:

XNET is the first DeWi network where early miners will have the opportunity to sell their tokens years ahead of the team and investors. Because the team and investors are locked up for 3-4 years, there is no ability to take profits during the build-out phase of the network.

XNET will be the first DeWi network to implement fee markets for data transfer. They will do this by making the $XNETD<>$XNET exchange rate a function of the priority / quality / location of data transfer, rather than a fixed price like Helium and Pollen. The exchange rate will be set by XNETMNO in the near-term, but there are ongoing efforts to implement decentralized fee markets natively within the XNET protocol.

While certain parts of XNET’s network operations will be centralized at XNETMNO, the buyback mechanism ensures that all network participants are aligned towards the same goal: maximizing data transfer revenue. For every dollar of offload revenues transferred over the network, XNETMNO (or, in the future, other DAO-approved parties) will need to acquire $XNET tokens and burn them into expiring $XNETD data credits. XNETMNO will acquire these tokens either from the open market, creating liquidity for miners to sell into, or - if miners are unwilling to sell their tokens - from the XNET foundation.

XNET is the first DeWi network to allocate a portion of its token supply to charitable works and organizations, primarily for incentivizing coverage in underserved areas of the country. The 4.3B $XNET tokens in the Foundation pool will be allocated over a decade or longer, with little impact to circulating supply in the next 1-2 years. However, it underscores the XNET community’s long-term commitment to providing cheap global connectivity.

We are not in the business of projecting near-term token prices. However, for an illustrative sense of range of outcomes, miners can use the following rule of thumb: at a monthly issuance rate of 500 tokens per miner, every $1M of monthly on-chain data transfer demand supports a $0.20 token price for 10K+ miners (conservatively assuming miners sell 100% of rewards). Taking a few more assumptions ($0.50/GB network revenue; 25GB/mo per-capita mobile usage; 33% roaming rate), provides a second rule of thumb: every $1M of on-chain data transfer revenue requires covering 250K end-users. In short: 10K nodes → covers 250K end-users → generates $1M monthly on-chain revenue → offsets miner selling pressure to support $0.20 token price. We believe the long-term opportunity for neutral host offload in the US is $2-5B of annual revenues.

Note: results are based on the stated assumptions that can be trivially replicated - not investment advice nor a prediction/projection of future events.

Bottom Line

XNET is building the first carrier-grade DeWi network. The founding team - Rich, Tom, Donal, and Alex - have world-class engineering chops, a decade’s worth of learnings and relationships in the telecom industry, and the audacity to try and empower a community of miners, manufacturers, and property owners to deploy the first neutral-host network at scale.

If you’re interested to join the community, or if have questions on our analysis, read the XNET whitepaper, join the Discord, or reach out on telegram (@moneromahesh or @salgala).