Telecom's Crucible Moment: Adopt DeWi or Die

TelCo Competitive Advantages Are Crumbling In Before our Eyes; Apple's eSim Rollout is a Crucial Tailwind to DeWi's Explosion

PDF TO LONG FORM ANALYSIS LINKED HERE

If you’ve read this Substack before, you know we like to go really deep - far deeper than Substack’s formatting and word limits allow. As such, going forward, all long form analytical research will be published here, and this Substack will share higher level findings and summaries of our research. On to the good stuff…

Decentralized Wireless (DeWi) skeptics are quick to point to a long list of memorable ideas that failed over the last decade (ie. spectrum sharing, ISP-in-a-box, mesh networking, and connectivity-sharing etc). Each of these were independently decent ideas, and many of the passed the "how big” test. But the acid test of a thesis isn’t “how big”, it’s “why now” given we’re all dead in the long run anyway. So why now?

TelCos are in a bit of a crucible moment: borrowing and input costs are rapidly rising, but they can’t raise prices because data costs are deflationary. Just a couple months ago, T-Mobile announced a price lock program promising never to EVER raise prices on a given contract again. On top of that, they have to come good on the promise of 5G, which will require hundreds of billions of dollars to build. Meanwhile, software continues to grow in efficiency and versatility - all the boxes and switches and different types of wires of the past can be managed using standardized commoditized hardware and powerful software. This requires far few employees and leads to higher secular margins. It’s obvious that the telco industry is undergoing a 0-to-1 transformation with everything at stake.

But there are a number of tailwinds aligning serendipitously to accelerate this transition. Here are a few key points to consider:

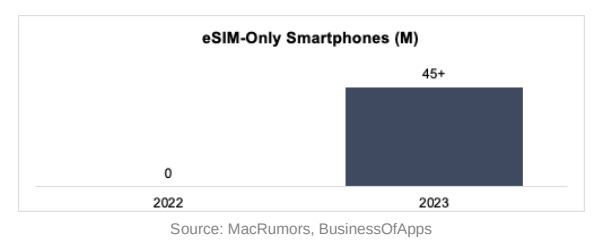

eSIMs have been around since 2018, but are FINALLY going mainstream. Earlier this month, Apple announced the iPhone 14 will have three times as many eSIMs as the prior generation (6 vs 2 eSIM slots), and - more importantly - will have zero slots for physical SIM cards. Given Apple’s production targets (95M+ iPhone 14s) and geographic split (40-50% US), we can assume 45M+ consumers will have eSIM-only iPhones next year.

eSIMs drive carrier switching costs down to near-zero. To test this theory, Sal (an 11-year Verizon customer) finally switched carriers. To join AT&T, he drove 15-minutes each way to the closest AT&T store and spent almost an hour signing up, guided by his very-friendly-but-clearly-paid-by-the-hour AT&T rep. To join T-Mobile, he downloaded an app and completed onboarding in less than 10 minutes, most of which was waiting for his eSIM to activate (watch this 30-second video, its crazy). eSIM product experiences are still nascent but will continue to improve, especially with Apple supporting native eSIM transfers via Bluetooth in iOS 16. Less than a week after Apple’s announcement, Verizon guided Wall Street towards its second consecutive quarter of negative net post-paid subscriber growth, sending $VZ stock to decade-lows. This more than just a bad quarter, it marks the beginning a fundamental shift in how consumers treat telcos: less like utilities, and more like services. The 1-2% monthly churn historically enjoyed by carriers is coming to an abrupt end in 2023.

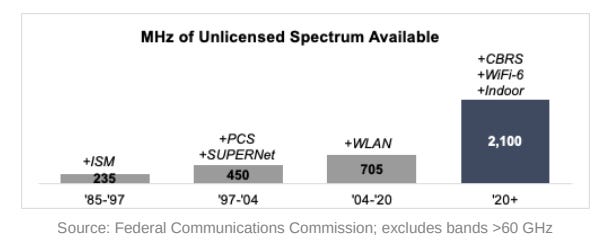

There is more unlicensed spectrum available to entrepreneurs than ever before. The vast majority of WiFi and Bluetooth technologies we use every day were built on 235 MHz of unlicensed spectrum that were set aside in 1985. Despite this sparking innovations that drove >$40B/yr of economic benefits, the FCC never doubled down on unlicensed spectrum—until now. The amount of unlicensed spectrum in the US tripled over the 35 years leading up to 2020; over the following 12 months, it tripled again.

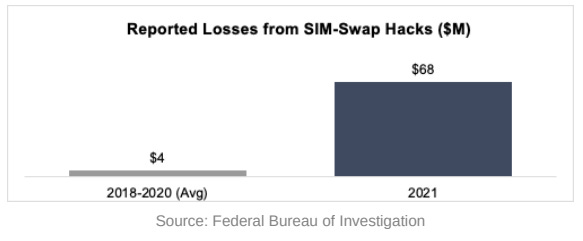

Vulnerable communications networks are being exploited by both state and non-state attackers. In 2021, hackers discovered one of the weakest links in the entire consumer internet supply chain: telcos’ customer support departments. In a SIM-swap attack, an attacker calls a telco’s customer support line and coerces the agent to transfer the victim’s SIM onto the attacker’s phone. Once this is done, a hacker can intercept every message and call, including SMS-based two-factor authentication for most email, social media, and bank accounts. As a result, SIM swaps can be devastating: the average reported loss is >$40K. Losses from SIMswap hacks grew >17x in 2021, driving higher churn for incumbents and providing an opportunity for challengers to differentiate on security/privacy.

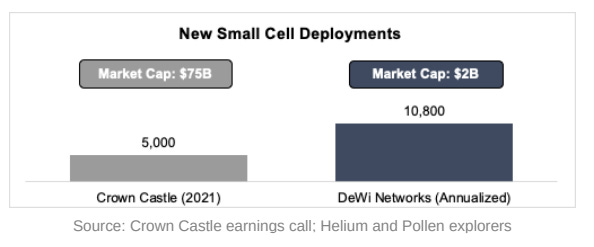

In some aspects, such as live data transfer, DeWi networks are still nascent; in others, DeWi is already outpacing the incumbents. Helium and Pollen’s small cell LTE radio networks are growing >50% MoM, with miners deploying >900 new outdoor radios in the past 30 days. In major cities like San Francisco, DeWi is already reaching density with >200 nodes actively providing coverage. In fact, on an annualized basis, DeWi is deploying more than twice as many outdoor small cells as Crown Castle, the largest small cell operator in the US.

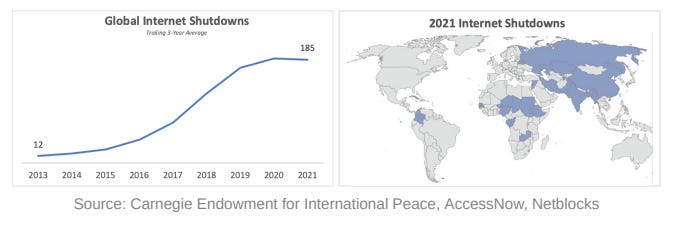

Governments are blocking internet access >10x more often than in years past. Ethereum’s homepage proudly states: “Ethereum's decentralized finance system never sleeps or discriminates. With just an internet connection, you can send, receive, borrow, earn interest, and even stream funds anywhere in the world” (emphasis added). Relatively few people in crypto are focused on the italicized part, but we think it’s incredibly important: what’s the point of having a censorship-resistant blockchain if governments around the world regularly shut down citizens’ internet access?

The timing is incredibly ripe for DeWi to start taking share, despite the market environment. Traditional TelCo moats are eroding before our very eyes. Switching costs, the backbone upon which TelCos are built are going down radically, accelerated by rapid eSim’s adoption. What’s more, carefully portioned spectrum, previously available to only to scaled companies, is becoming easier and easier to access. As happened with Financial Services’ transition to Fintech, entrepreneurs can focus on winning on customer experience: TelCos have some of the lowest customer satisfaction scores out there!

On the other side, centralized systems are unable to deal with the scale and scope of attacks and are ceding more control to governments in the process. Your data and privacy are going with it. This is kind of scary if you’re American, but downright terrifying if you’re Latin-American or Asian.

Where are the tides of change most apparent? Growth! DeWi networks are still compounding at double digit monthly network growth. You’re not going to find that ANYWHERE else today.

If you’re a Telecom nerd like we are, or honestly any kind of nerd, continue reading here! We’re less than 20% of the way through and haven’t even gotten to what’s out there in DeWi yet…

For all of our consolidated writing, check out our website: ev3.xyz/writing.

(PS: I, along with my best friend Sal, the collective “we” in this piece started a small venture business together that invests in Decentralized Networks. If you’re building, or interested in the industry please reach out to moneromahesh@protonmail.com !)