Helium's Revolutionary Value: A Guiding Conversation

I must make my defense citizens of the internet! and endeavor to remove from your minds the doubts over Helium and Cryptoeconomic systems which you have long entertained

“Is this a targeted effort on behalf of Party Streamers Sector to crush the Big Balloon lobby?”

You wouldn’t believe some of the responses I got to my first Helium article. To the commentor I say, that’s incredible: I were going after the party balloon industry, making input costs unsustainable is brilliant! But they missed the actual article, about an innovative and groundbreaking cryptocurrency with a real-world use. In case anyone else missed it, Helium is a category-redefining network which allows people to become their own network providers, earning cryptocurrency in the process. If my piece wasn’t enough, or you’re not familiar with the project the NYT did a fantastic writeup on it here, which I would suggest you read first.

Big Balloon lobby aside, I spent a ton of time after writing the last Helium article talking with smart, sophisticated investors, helping them understand the project. Most people just needed the concept explained clearly and succinctly. However, one conversation with the daughter of one of the more successful value investors of his generation stuck out as worth sharing. Currently employed at a hedge fund, her trading book was down a lot, and she was exploring the wild west of hyper-convex cryptocurrency as a potential way to get back even. That said, her father had lived and died by his “buy low for cash flow” mantra, which she viewed as primordial among investment frameworks, so it was never going to be an easy Zoom conversation.

“Helium is really cool and might actually be a real use case for crypto, but there’s no way this ends well, right?” she started.

Time frame is everything, and the last 50 years did little to convince her that her father’s framework may be wrong, even if the last 10 taught her there may be more than one way to be right. Investors measure successes in capital gains, and she had plenty even if she didn’t have the most. In any case, here’s how our full conversation followed (if you want the two-minute punchline, scroll to the first graphic):

Athena Marks: But who does Helium provide value to? The owners of the token aren’t entitled to the cash flow. And they haven’t figured out how to manage the network on a consistent basis. Why would this ever be a good investment?

MoneroMahesh: Everyone! New systems of value creation, like Helium (HNT), are always going to misunderstood when they first emerge. Just as it was with the launch of the internet in the 1980s, just as it was with E-Commerce in the late 90’s … Come then Athena, tell me, do you not consider it the greatest import that society should create as much value for its citizens as it can?

Athena Marks: That’s a lot of big words without making any sort of substantive point. This really must be a bubble market after all.

MoneroMahesh: So then how do you define value creation?

Athena Marks: Obviously as the profits generated by shareholders. That’s why breaking fiduciary law is a crime. Value is what the company returns to owners and employees to the extent they are owners.

MoneroMahesh: Maybe that’s one way to define it, but it’s a narrow way to do so. I don’t disagree, but I think we need to broaden our definition. Is the company the sole focus of value creation, or is the public a factor as well?

Athena Marks: When it comes to investing, the company should be the sole focus. The company provides certain profits, which is the difference between its sales and costs. That profit is then redistributed to the owners. This is a company’s core utility, a structure through which capital and other resources are organized and the spoils distributed among shareholders. It has been true since the joint-stock companies of the 17th century.

MoneroMahesh: So, shareholders are the only beneficiaries?

Athena Marks: No, it’s multi-faceted. There are many stakeholders who are impacted by the actions of corporations (see: climate change). But when focusing on economic value creation, you evaluate what you can.

MoneroMahesh: Economics calls what you described above producer surplus. But what about consumer surplus? Does the consumer not have a role to play as well in maximizing economic utility?

Athena Marks: Sure, the customer has a role, but the customer is paying, so one can’t really quantify the value provided. I don’t know how much they are willing to pay. Corporate valuation follows this framework and has for years.

MoneroMahesh: Frameworks fade in relevance in the face of real change. But do we agree that value creation is a function of maximizing utility to all members of a transacting ecosystem, not just to one?

Athena Marks: Yes, but utility maximization follows the profit motive.

MoneroMahesh: Meaning?

Athena Marks: You’ve read Adam Smith. You know a competitive profit-driven market always drives the best economic outcome to all parties.

MoneroMahesh: Really? What about an oligopolist. Does she maximize the societal utility in competing in a supply-restrained market?

Athena Marks: In some ways, yes! Oligopolists are paying rents to themselves but are still providing a service to society. And they pay a lot in taxes by charging higher prices, which goes to the government. That must be value to society.

MoneroMahesh: Sure, but cost of the service is wildly inefficient relative to value provision. Who loses?

Athena Marks: It’s more dollars to the government and more dollars in the consumption component of GDP. That must be good for society.

MoneroMahesh: Yes but you’re missing the efficiency point. Everything has a price: if society overpays relative to the cost of producing something, that’s not value creation.

Athena Marks: I guess it may be situational, based on how hard it is to produce a service. But from a pure capitalist perspective why should society care about the price so long as it can afford it?

MoneroMahesh: Because producer surplus comes at the cost of consumer surplus in the oligopolist case. You’re thinking of society as a whole, not the individual! Do they have infinite resources? An oligopolist will never maximize societal value creation because they make their buck by taking yours!

Athena Marks: Well, my father’s net worth is $10bn…

MoneroMahesh: Economic utility must be the difference between the benefit from providing a service, and the cost of provision, to ALL ecosystem participants.

Athena Marks: You’re not seriously arguing that the corporate capitalist system that made this country great is outdated, are you Karl? The invisible hand still works, look at how it’s organized our tech sector! We created trillions of market value from scratch, just from facilitating corporate competition.

MoneroMahesh: I’m not debating it works, I’m arguing there are different ways to enable that same competition. We get so bogged down it what’s easy and works that we’re blind to what might be out there.

Athena Marks: What’s that thing people always say about not fixing things that aren’t broken?

MoneroMahesh: Broken? Look at Facebook: by monetizing their network through ads, they’ve created a human catastrophe where we can’t even quantify the negative externalities! Facebook’s core network is deteriorating because alignment with the community has disappeared: the desire to generate tons of centralized revenue to support the network led to them forgetting what people wanted: connectivity to their middle school ex...

Athena Marks: What did you expect them to do? Provide a public good? You clearly haven’t seen the Social Network… Zuckerberg weaponized social incentives.

MoneroMahesh: Yes, I have, and I don’t disagree. But we’re in a different place today and should be extra wary in building networks today that incentivize the network and community to act with a common interest.

Athena Marks: And that’s exactly my point, that we need to be careful about what incentives we allow, because we don’t want another Facebook.

MoneroMahesh: Not my point, this is a completely different type of incentive to anything Facebook ever used. Helium has pioneered a new financial model that uses strong token-based incentives, in a way we’ve never seen before, to deliver “permissionless,” data transfer at a fraction of current cost.

Athena Marks: You’re still dancing around where Helium adds value.

MoneroMahesh: There’s already usage on the network and certain local economies are finally coming to…

Athena Marks: But there really isn’t much activity on the network today.

MoneroMahesh: What about the $500m of miner rewards paid out in the last year? The network is providing real economic value to people.

Athena Marks: Miner fees are just inflation. That’s only an argument so long as someone’s buying your token to support its price. That’s not real revenue.

MoneroMahesh: What about the ~$60m of data transfer credits burned this year on a run rate basis?

Athena Marks: Some of that gateway installation fees that aren’t real recurring revenue, and those will disappear as the network scales. Only a portion is real data transfer. And there aren’t even a ton of apps being built that rely on Helium.

MoneroMahesh: Those data-transfer fees will increase significantly with time as the network scales. The underlying growth rate of “real revenue” as you define it is >1,000% vs. 500% annual router growth. Once you get the basics right here (ie build the network), revenue grows exponentially. Each new node in a network adds an exponential amount of potential revenue because of the new connections it enables.

Athena Marks: But is the network even built? I still don’t understand how you’re getting millions of people to put these up in their windows.

MoneroMahesh: Were you listening? Incentives! A network by its very nature relies on diverse and disparate parts working together to facilitate its success. TelCo’s brute force this by spending a lot of money upfront to avoid having to rely on a distributed network. But if you can incentivize the network properly, it’s a hell of a lot cheaper than how TelCos do it.

Athena Marks: I assume this is where the token comes in?

MoneroMahesh: Precisely. Helium’s genius innovation is in creating a model of governance that incentivizes every Helium network participant to maximize the value of the HNT token over the long term by participating in the network’s use and governance. Luckily the strength of the blockchain is a problem developers can fix over time as Helium scales.

Athena Marks: This sounds like a Ponzi to me. To be clear: you’re printing a bunch of tokens that are worthless, and selling them to investors who need to believe they have value, and then rewarding participants of the system with tokens that rely on collective belief to have value?

MoneroMahesh: Isn’t that how every country is created? The development of a new country first requires buy in to the country’s medium of exchange. The US spends the dollar before it’s printed: does that make the US a Ponzi?

Athena Marks: Sure, but countries have roads and goods that support the creation of the currency. This has nothing.

MoneroMahesh: Not nothing. Countries provide basic infrastructure (roads, rules, laws) as well as economic paradigms (fiscalism, monetary policy) to facilitate the creation of new products and services.

Athena Marks: Go on…

MoneroMahesh: To allow this basic economy to thrive, the country creates a medium of exchange that constrains economic activity to value add. In some countries this can be a unit of account (dollar, bitcoin) in others, it can be a unit of value (Ethereum, HNT). The infrastructure is the network and the data transfer mechanism it facilitates.

Athena Marks: But you’re still missing the purpose of the country: to organize through laws, regulations, and rules.

MoneroMahesh: These are all codified on the blockchain and are automatically enforced by code. Rules and laws of operating are executed autonomously, and any governance changes is handled by HNT owners.

Athena Marks: But how is this like a country? Who are the citizens and participants?

MoneroMahesh: There are four: the miners who facilitate data transfer, the users who pay for data transfer, the investors who govern the network, and the owners who continue to support build out. Five if you count validators, but they’re usually a subset of one of the four. See what I’ve shared on screen:

Athena Marks: So, you think the system works because every player is incentivized to hold and lock up the token over the long term. Maybe for investors and founders but you’re wrong on participants and miners.

MoneroMahesh: Participants are indifferent on token price because data credits to use the network are priced in USD, while tokens are priced in HNT. They don’t care if HNT is $1 or $100 because they can spend a fractional token but have a slight preference for a higher price so they’re spending less to transfer data. When you receive Venmo cash, do you cash out immediately?

Athena Marks: What’s Venmo? I use JP Morgan.

MoneroMahesh: LOL. Well people rarely transfer digital stores of value to cash immediately due to inertia. This fact, combined with the sheer convenience factor of holding to facilitate your next data transfer leads users of the network to hold HNT. This effect will be far more pronounced for frequent users of the network.

Athena Marks: Ok but on miners you’re wrong. They need to generate income, so they will sell the token.

MoneroMahesh: What do you mean?

Athena Marks: It sounds right now like a lot of the miners are crypto fundamentalists. Over time, they’re going to be infrastructure investors. No?

MoneroMahesh: Hmm, I guess that’s the case.

Athena Marks: And infrastructure investors are looking for yield, right? So they’re going to be a more active seller over time and the system will fall apart.

MoneroMahesh: Yes but…

Athena Marks: So, if data transfer rewards are paid to miners over time, and miners sell, supply and demand will be similar over time and the token price shouldn’t appreciate. What do you have to say about that?

MoneroMahesh: You’re right. That’s true.

Athena Marks: Exactly, so how can you claim the incentive system is in order?

MoneroMahesh: Because of governance. Predicting and guiding miner behavior has been one of the Helium team’s core focuses over the last two years. You’re right, the biggest bottleneck to the system is miners selling.

Athena Marks: Explain?

MoneroMahesh: Because miners earn a significant chunk of network economics today and wouldn’t want that to change, would they.

Athena Marks: What do you mean?

MoneroMahesh: Well, miners buy a 5-year life asset, and have little to no cost of running it. Therefore, all their upside is the future economics from data transfer. They are incented to be long-term thinkers because of their asset life and will therefore focus on maintaining economics.

Athena Marks: But why wouldn’t they just take all the yield upfront and pay off their routers immediately, then take the upside over time?

MoneroMahesh: In the meantime, if another group has significant control over the network, the group could tip the economics towards themselves, and the miners who spent hundreds of dollars on their routers are shit out of luck!

Athena Marks: Oh, so everyone wants control of governance to send all the rewards to themselves vs. other participants in the system.

MoneroMahesh: Yes, exactly.

Athena Marks: But why wouldn’t they just stake their tokens, vote, then unstake them and sell them? They could hopefully earn enough by the next voting cycle to maintain their voting position? Or buy in ahead of time?

MoneroMahesh: You’re missing one piece. Voting power in the Helium system won’t be driven by just staked amount as it is for most networks. Helium pioneered the concept of proof of stake-time: your voting power is determined by staked HNT * duration of staking per proposal 41.

Athena Marks: So, you have to commit your staked Helium for a period of time? How long?

MoneroMahesh: Your voting power is determined both by the amount of Helium you stake, and then assigned a progressive multiplier based on how long you stake for. The minimum time frame is 6 months, so anyone staking can’t sell for that long.

Athena Marks: Got it. But that sucks. Why would I lock up my token today when I can earn 5% on a USDC lend?

MoneroMahesh: You additionally earn ~6% for staking your HNT today – combined with governance, that provides some powerful incentives not to sell. 36% of HNT is staked today. I’ve laid this out on-screen.

Athena Marks: All of this is relying on one fundamental assumption: that the HNT token is worth anything.

MoneroMahesh: And you’re yet to believe this?

Athena Marks: Well, I just don’t see how value flows to the token if cash flows go to investors/miners.

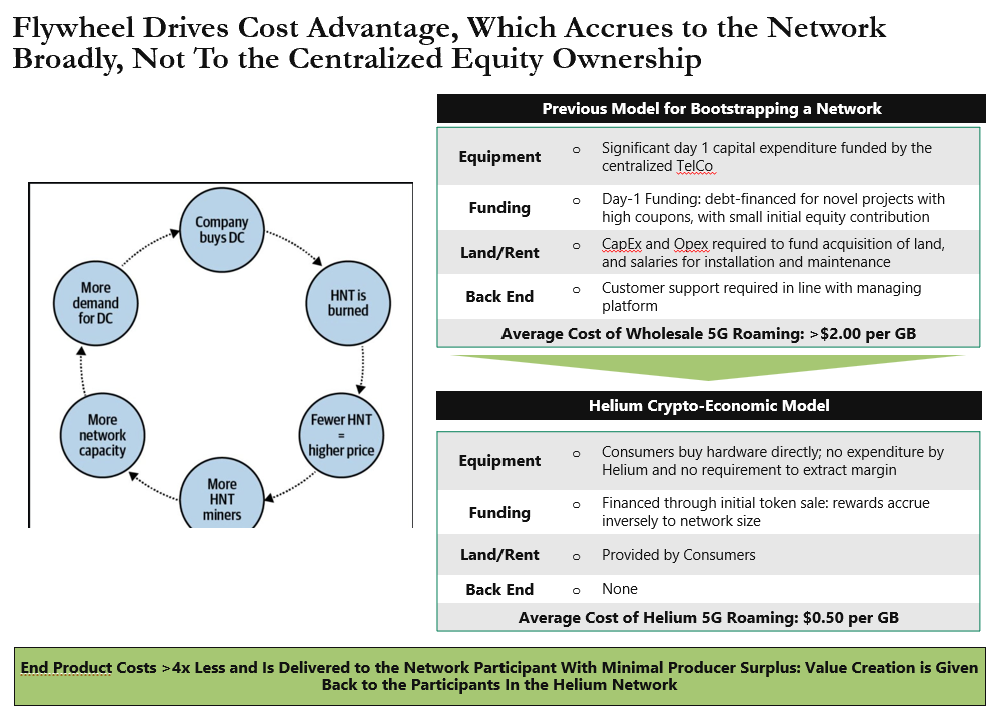

MoneroMahesh: Well unlike a traditional TelCo, the focus here is on passing a chunk of the joint surplus back to the network participants, rather than earning as much centralized cash flow as possible.

Athena Marks: Ok, and?

MoneroMahesh: Network participants, who do so through ownership of the token, accrue back a big part of what would be the producer surplus charged by oligopolistic pricing models of traditional centralized companies

Athena Marks: So, what you’re saying is the upcharge that would normally be an oligopoly rent is given back to the users and members of the community?

MoneroMahesh: Exactly because token incentives make the users act like owners. There will be a net demand for the tokens over time created by:

1) increasing demand for data transfer (market growth)

2) increasing adoption of the low-cost solution relative to paying oligopoly rents (share growth)

At the end of the day, you’re not going to buy milk for $2 if you can get it for $0.50 right? That will drive outsize demand to the system that leads to token price appreciation. And you’ll drink a lot more milk at that price!

Athena Marks: Getting very theoretical but ok..

MoneroMahesh: Yep, so then with these large factors driving growing demand, against a backdrop of slowly increasing supply, token value should explode over time given scarcity.

Athena Marks: So, it’s a massive game-theory experiment, the result of which is a network-enabled way to deliver a service.

MoneroMahesh: That’s one way of putting it

Athena Marks: But why does the HNT token itself have value. I understand your arguments around supply and demand. But you can’t value it like a cash-flow asset. How do you have confidence it’s worth anything?

MoneroMahesh: Cash flow may be king, but we don’t live in monarchies anymore. The HNT token is the fulcrum piece to making the entire Helium network function. Much like our modern monetary system, buy in from the four participants is required to imbue the token with initial value.

Athena Marks: So, what you’re saying is, society needs to first collectively decide it’s worth something, not nothing.

MoneroMahesh: Why is the Rupee worth anything? It’s backed by the roads and promise of Indian industry. But we don’t try to value the rupee like a cash-flowing asset. We understand instead how the Indian economy is going to perform over time and buy the Rupee if it will accrue increased purchasing power.

Athena Marks: Oh you’re talking about how purchasing power parity is calculated…

MoneroMahesh: It means, the Rupee gains value as the Indian economy produces services of equal value but lower cost to the rest of the world, accruing purchasing power as a result.

Athena Marks: So what you’re saying for HNT, is that it accrues value as the Helium economy grows?

MoneroMahesh: Yes.

Athena Marks: And that growth can be predicted through growth of data credit use on the network

MoneroMahesh. Yes, the token’s real utility is driven by 1) it’s control over governance and therefore the entire economics of the Helium network and 2) it’s binding and crucial role as a fuel-like constraint in any network activity. The result of this is value accrual to the token as the currency eventually becomes deflationary.

Athena Marks: But stepping back, all of this assumes the milk costs $0.50. You don’t even know the price of “milk” in the HNT example!

MoneroMahesh: It’s very simply the fact that the network can facilitate data transfer at <25% the cost of the traditional TelCos, without the need for significant human oversight.

Athena Marks: Wait WHAT?

MoneroMahesh: Yes, you heard me. The Helium network can transfer data at ¼ the cost of the traditional TelCos, permissionlessly. I’ve put together a simple chart to explain below.

Athena Marks: How!?

MoneroMahesh: Well, Helium doesn’t have any of the traditional costs that a TelCo would: salary, benefits, rent etc. Therefore, they can provide the service at a far lower cost.

Athena Marks: If that’s true, the value proposition angle is starting to make a whole lot more sense. Then how do you think about the HNT token’s actual valuation?

MoneroMahesh: You still haven’t gotten it have you…

Athena Marks: I’m a student of science and precision is my highest priority.

MoneroMahesh: Then you’re not able to distinguish the forest from the trees. Within the Helium network, almost all value created by data transfer accrues to miners and investors within the network. Even the Helium Security Token (HST) is just an annuitized form of HNT, so the only ultimate value accrual mechanism within the system is the HNT token. It should increase in value directly in proportion to positive demand for data transfer.

Athena Marks: So, a token is skeumorphic to a share, and you use multiples to get the right valuation outcome?

MoneroMahesh: A token isn’t a share. It doesn’t give you a right to Helium’s cash flow, or redeemable ownership to anything. What it gives you is a claim to governance, and a supply-constrained unit of exchange.

Athena Marks: Ok so that how do I put a dollar value on it?

MoneroMahesh: You forget investing is an art not a science. All our valuation mechanisms are just tools to benchmark the eventual value creation potential a project has. Understand the market today, understand how it’s going to evolve over time, and understand how Helium enables to capture of that market growth into tangible value. That should be how you think about investing here. Here’s an example (in thousands).

Athena Marks: But that just gives you the market size. That doesn’t tell you a lot about the company.

MoneroMahesh: Well, why don’t you take me through how you would do Verizon.

Athena Marks: Sure, I’d start with company revenue, and understand what the margins of the business are.

MoneroMahesh: Ok, go on?

Athena Marks: Once I have the margins, I adjust for non-cash items, so I understand how much real, recurring cash flow this business has.

MoneroMahesh: Ah, so you look at value in cash flow terms?

Athena Marks: Yes, so the value of Verizon is that cash flow, times a multiple I’m willing to give it based on how sustainable Verizon’s competitive advantage and growth is. So, with $45bn of Cash flow at 9.0x multiple, Verizon is worth ~$400bn today.

MoneroMahesh: That makes a lot of sense. So cash flow is just revenue times a margin right.

Athena Marks: In simple terms, yes.

MoneroMahesh: So what we need to add to our analysis from earlier is a measure of Helium’s free cash flow, and a multiple, to give credit to Helium’s competitive advantage and implied growth.

Athena Marks: Yes, that would make sense to me then.

MoneroMahesh: Great, we assume some measure of market share to get Helium’s revenue. Revenue is just cash flow because Helium doesn’t have central operating costs, so there’s your cash flow number. Now in terms of your multiple, what do you think about applying Verizon’s EBITDA multiple?

Athena Marks: That doesn’t make any sense. Verizon is a Telco provider. This is a TelCo servicer given offload focus and traffics in small cell. They shouldn’t be valued similarly.

MoneroMahesh: Sure, but are Helium’s competitive advantages greater or lesser than Verizon?

Athena Marks: Lesser! Verizon has a decades old brand, and the support of the people for its services. In addition, they’ve already laid all the cable.

MoneroMahesh: Yes, but they’ve done that through centralized capex. That means their real advantage is capital markets and installation. And those are commodities. Also, people hate Verizon so I’m not sure if the brand is helping! Plus Verizon is growing way slower than Helium…

Athena Marks: It’s still fully built vs. Helium, which is a lot of option value. Also, Helium is small cell, so it’s a different type of risk.

MoneroMahesh: Ok but look at Crown Castle (scaled small cell services business). They trade nearly 14x and are arguably more like Helium than Verizon. Let’s simplify this and assume Helium punitively trades at half of that. This is how you value Helium on a forward basis.

Athena Marks: Got it, very rosy. But this still makes a number of fundamental bets right.

1) Growing demand for data transfer, in which Helium has a lasting cost advantage

2) People want to earn passive income in cryptocurrency from providing data services

3) Helium’s tokenomics and governance will adapt with time

MoneroMahesh: Every investment makes a number of fundamental bets. If the above are Helium’s I’m going all in.

(end)

The joint incentivization model Helium pioneered creates checks and balances on every other network participant. Control over governance, and the economic paradigm is crucial, and the system ensures each network participant is maximizing their voting power. Because voting power is governed by both quantity of locked HNT, and the time period for which it is locked up, people are incentivized to remove their HNT from the liquid supply quickly and are unlikely to bring it back. The result should be steadily increasing demand for HNT driven by demand for DCs over time, against a liquid supply that should increase at a much slower rate.

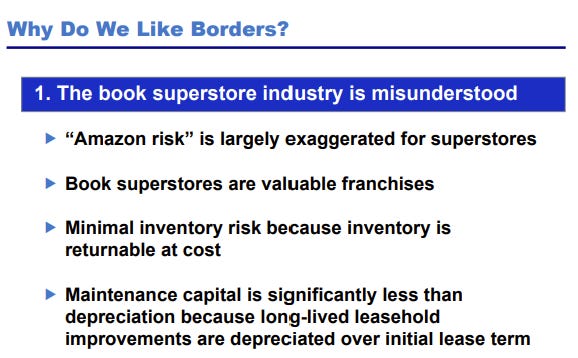

Does anyone remember Bill Ackman’s famous long-Border’s pitch 2006 (”Don’t judge a book by it’s cover!”)?... Poor guy missed the biggest secular trend of the decade. Seriously, please go back and read the Thesis; here’s my favorite page:

Remember, Bill Ackman isn’t your grandmother’s mutual fund manager — when he published this thesis he was running a multi-billion dollar hedge fund and had been in the investment business for over fourteen years. His hedge fund, Pershing Square, eventually owned 40% of Border’s equity before it filed for chapter 11 bankruptcy in 2011. The problem is Bill misunderstood what Amazon would be and therefore lost big when the present decoupled from history: in doing so, he missed one of the most powerful forms of value creation of the early 21st century – Amazon’s transformation of paradigms surrounding physical good and content delivery.

The HNT model may be worthy of a Harvard Business School game theory case study, pioneering a system that cautiously balances the profit seeking incentives of ecosystem participants, alongside the potential for collaboration between users and providers of the network to drive outsized value creation in the form of a radically lower cost for a widely available service. Investors, miners, and participants need to buy into the value of the HNT token as a starting point for any single piece of the network to have any value. With that initial step fulfilled, collaboration can drive unpredictable but unprecedented outcomes across the whole network, vs. being limited to modes of creating centralized cash flow that peril consumer protections or require suboptimal use of the network. Bill’s lesson is a timely one: being on the wrong side of change can be a costly decision.

Luckily for him, hedge funders rarely put their money where their mouth is. But you can!

As always, the slides presented here are available on request from: moneromahesh@protonmail.com. Please reach out with questions/ideas.

A BIG thanks to all of the following people/anons, who were beyond helpful in providing great feedback.

@Danconia.Eth @Richhomiecon @Jplats @DeWiGo @IndianJonesGovind and a few more that preferred to keep their pseudonyms anonymous here.

Disclaimer: The author owns a lot of HNT. Not Investment advice (if the government is reading this).