The ex-Dean of Harvard Business School will tell you: “one should always be making decisions now with a view for what the world will look like in 2-3 years-time.” Fair play, but crypto land is measured in dog years: revolutionary technology quickly becomes old news as the new wave emerges. Getting the underlying foundations and governance model right is key to moving quickly and planning for an ever-changing future.

Enter Helium, who’s governance model and tokenomics need revision to allow networks at different stages of their lifecycle to scale concurrently at different rates (LoRa, 5G). Part of this process includes removing ideological confusion: a rebrand of Helium Inc. (the centralized company) to Nova Labs is part of the equation – it should be clear as day now that Helium itself is the People’s Network alone and will be tackling the largest challenges in building decentralized wireless networks, including 5G.

But as much as we’d love to sit here gleefully plotting the downfall of AT&T, it could be some time before we see the 5G product viably deployed even in a last-mile framework. That said, Helium’s partnerships with FreedomFi and Dish are aimed at penetrating the 5G market soon: we’ve previously estimated that even getting to a 10% share could portend a >$50bn value for the network, so having the right structure to grow into is a crucial driver of long-term success. The obvious next question then regards how to best scale the nascent network (5G).

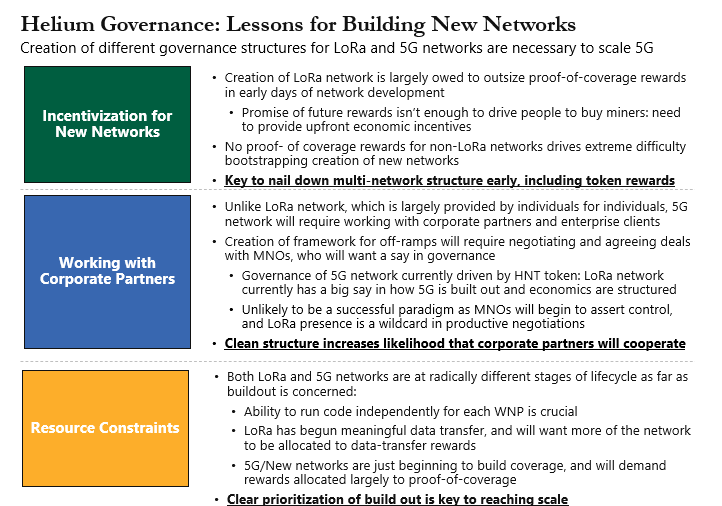

Helium participants point to the biggest driver of LoRa’s success being early proof of coverage rewards: you can’t make someone spend hundreds of dollars on a router and defer income indefinitely until the network reaches scale: they need to see some interim return. Furthermore, the short-range high-powered nature of 5G implies more of an enterprise use case: Helium will have to establish key partnerships with MNOs and MVNOs to scale the 5G product. With LoRa and 5G governance comingled in the HNT token, ongoing resource constraints are likely to drive partisan outcomes. The important lessons are summarized below:

Against this backdrop of uncertainty and change, the Helium Foundation rethought the system and came up with one of the most fundamental but exciting re-organizations of the Helium network since inception. The key changes follow below:

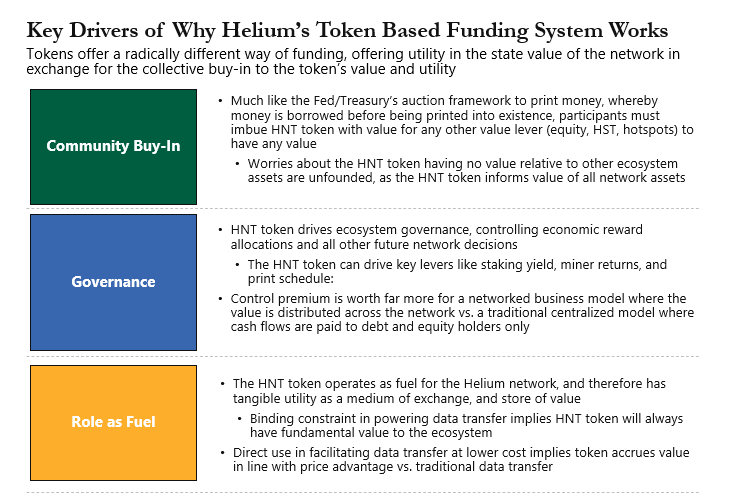

Implicit in this model are a number of fundamental changes to the network that definitely affect both the economics of the network at large, and the value represented by the HNT token. Understanding the implications to the HNT token requires distilling the transaction mechanics:

A similar amount of value is driven to the HNT token despite the changes to structure, with an increased incentive to lock up tokens driven by bonding and the 0.3% transaction fee implying lower outstanding supply at any given point vs. previous model. Key changes to value drivers are:

Where might this hit bottlenecks? If miners start selling their rewards, then each re-minted HNT token is sold rather than locked up: higher data usage leads to more burn which leads to more miner selling and significant downward pressure. But this is unlikely: as previously discussed, miners are well incentivized to lock their tokens up. The likelihood of this happening is further reduced in the new model due to the new 0.3% transaction fee, but mass miner selling, in the face of stagnant demand, remains one of the biggest risks to the token’s price appreciation over time.

A potential solution could be introduction of lockups on mined Subdao tokens, creating an incentive framework to drive miners to stake more. This could be as simple as a 180-day lockup on all newly mined tokens, which would incentivize miners to immediately stake to maintain their economics. In general, more buy in from lockups should only increase alignment of incentives across the network.

Helium was one of the first crypto-economic models to solve the problem of bootstrapping an early network requiring heavy CapEx. Helium’s genius lies in a crypto-incentivized model that checks the behavior of all other network participants, and this structural revision only reinforces the previous paradigm. Initial investors and Helium team still need to support HNT token value given it acts as their unit of rewards. Miners need to lock up the token and reduce supply to maintain economics. And network users need to buy the HNT token to access the network. The system works because HNT token is the gas that powers the machine. And nobody could argue that, if a producer were able to find a way to produce gas at 25% of market cost, that the producer hasn’t created genuine economic value.

The structural revision is a necessary one, and one that preemptively solves a lot of headaches that would otherwise emerge around governance: and we’re big believers that proactive governance is the most effective tool networks to avoid falling victim to crypto’s inevitable macro cycles.

As always, a shout out to the brain trust: @danconia_crypto, @RichHomieConE, @Jplat12, @DeWiGoSite.